Introduction:

In the evolving world of cryptocurrency, decentralized exchanges (DEXs) have become a pivotal development, offering a different approach to trading digital assets. This article explores what decentralized exchanges are, how they work, and their advantages and disadvantages compared to traditional exchanges.

What Is a Decentralized Exchange?

A decentralized exchange (DEX) is a platform that facilitates the trading of cryptocurrencies in a way that is independent of any central authority. Unlike traditional exchanges, DEXs operate on a blockchain that makes the transactions transparent, immutable, and secure. They allow users to maintain control of their funds, thereby providing a higher level of security and privacy.

How Does a DEX Work?

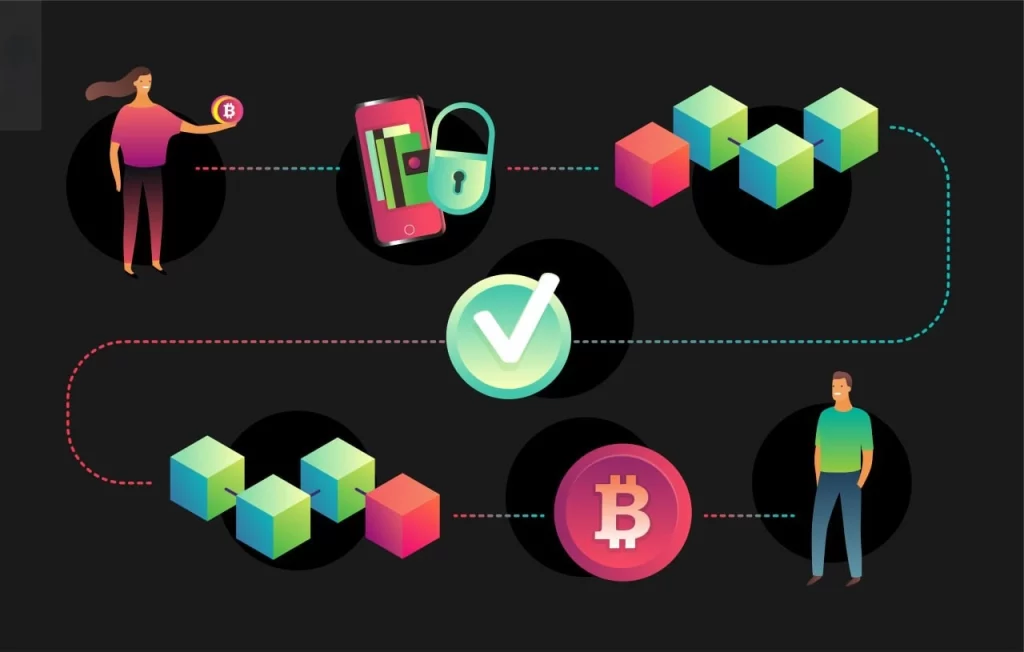

Blockchain Technology

The backbone of a DEX is blockchain technology. It uses smart contracts—self-executing contracts with the terms of the agreement directly written into code—to facilitate trades directly between users.

Peer-to-Peer Trading

In a DEX environment, trading occurs directly between users (peer-to-peer) without the need for intermediaries. This system contrasts with centralized exchanges, where the exchange controls the order book and acts as a middleman in all transactions.

Advantages of Decentralized Exchanges

Security

Without a central point of failure, such as a single server or a centralized database, DEXs are less vulnerable to hacking attacks. Users are not required to transfer their assets to the exchange, reducing the risk of theft from exchange breaches.

Privacy

DEXs do not typically require users to go through identity verification processes, offering privacy and anonymity in transactions.

Control Over Funds

Users on a DEX retain control of their private keys and therefore their funds. This autonomy prevents the loss of assets due to the exchange’s insolvency or fraudulent activity.

Disadvantages of Decentralized Exchanges

User Experience

The lack of a central authority in DEXs often results in a less intuitive user interface and poorer user experience compared to centralized exchanges.

Lower Liquidity

Since DEXs are relatively new and sometimes complex, they often suffer from lower liquidity compared to their centralized counterparts, leading to larger price spreads and longer wait times for order fulfillment.

Limited Functionality

Many DEXs do not support advanced trading orders, such as stop-loss orders, which can limit trading strategies.

Why Are Decentralized Exchanges Becoming Popular?

There are several reasons why decentralized exchanges are gaining popularity among cryptocurrency traders. One of the main advantages of DEXs is that they offer increased security and privacy compared to centralized exchanges. Since users retain control of their funds at all times, they are less vulnerable to hacks and security breaches that can occur on centralized exchanges.

Additionally, decentralized exchanges are often more resistant to censorship and regulatory intervention. Since DEXs do not rely on a central authority to facilitate trades, they are not subject to the same regulatory requirements as centralized exchanges. This allows users to trade cryptocurrencies freely without worrying about their funds being frozen or seized by authorities.

Conclusion

decentralized exchanges offer a secure, private, and transparent way to trade cryptocurrencies without relying on a central authority. As the popularity of cryptocurrencies continues to grow, DEXs are likely to play an increasingly important role in the cryptocurrency ecosystem. By understanding how decentralized exchanges work and the benefits they offer, cryptocurrency traders can take advantage of this innovative trading platform to trade cryptocurrencies safely and securely.